Examination / Audit Help for Dummies

Wiki Article

The Single Strategy To Use For Irs Unpaid Back Taxes

Table of ContentsRumored Buzz on State Of Michigan Tax PreparationTax Audit Defense Can Be Fun For EveryoneAn Unbiased View of Corporate StructuringNot known Incorrect Statements About Examination / Audit Help What Does Payroll Taxes Offer In Compromise Mean?3 Simple Techniques For Accounting Services

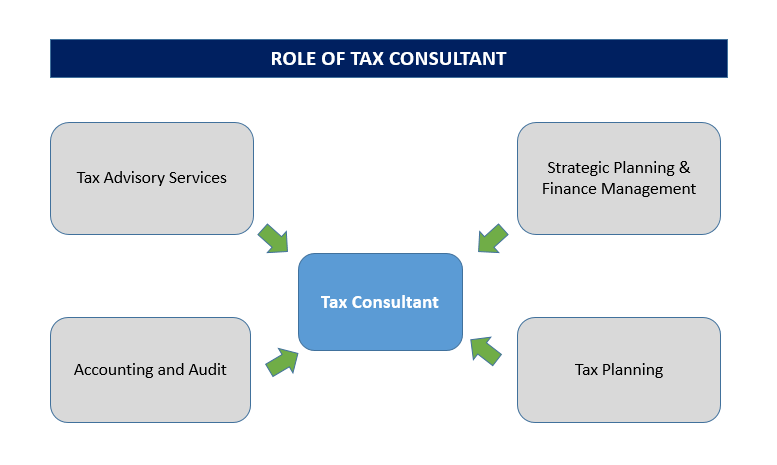

Often credited to Ben Franklin is this popular quote:"Nothing is certain besides fatality and also tax obligations." Many individuals locate tax obligation problems to be confusing as well as burdensome, as well as, as opposed to doing their own taxes, they frequently like to employ a professional (Tax Planning). Taxpayers that have substantial assets or complex personal financial resources, may decide to function with a tax specialist, that can utilize her in-depth understanding and also experience to reduce her clients' tax obligation obligations and protect their rate of interests.Tax obligation laws change frequently, and also lots of people and company owner are simply uninformed of the myriad of regulations that control deductions, credit scores and also reportable income. Therefore, the ordinary taxpayer might make blunders that can cause the underpayment or over payment of taxes. If the taxpayer underpays his tax obligations, he might be subject to an IRS audit, with feasible penalties.

A tax consultancy is an organization that gives professional recommendations to tax obligation filers. A good tax consultant recognizes tax obligation regulations, and is able to recommend methods that lessen commitments while also decreasing the possibility of an audit that could bring about a dispute with the internal revenue service or with a state tax obligation firm.

The Facts About Penalty Abatement Uncovered

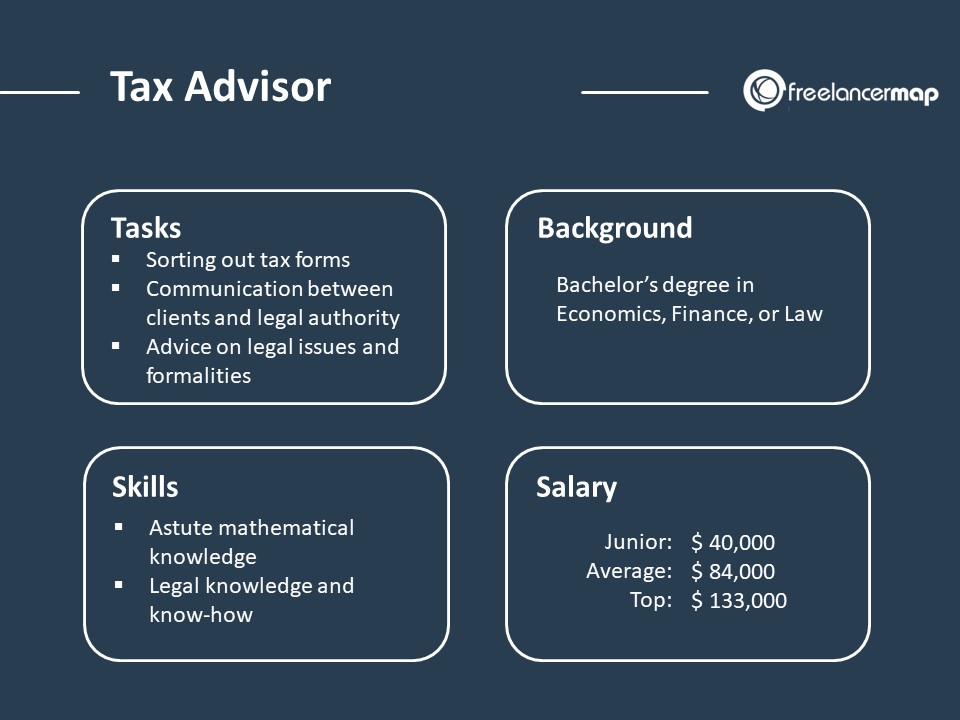

A tax obligation preparer is someone that prepares income tax obligation kinds, such as the 1040 or 1040 EZ, for others. The profession is loosely controlled: tax obligation preparers typically complete a brief training program, register with the internal revenue service to receive a tax preparer number, and, in some states, must sign up with the state firm prior to starting job. look at this site.

Assisting clients with tax issues during as well as after a considerable life transition, such as a marital relationship, divorce, fatality of a spouse or birth of a child. Finishing intricate tax types address and also timetables that the majority of tax obligation preparers are not familiar with. Standing for a customer in transactions with the internal revenue service or various other tax collection firms.

Below are some common requirements for ending up being a tax obligation expert: Coming to be a tax preparer typically only calls for completing a brief training program. Some states, such as The golden state, need tax preparers to complete a program authorized by the governing company that signs up or licenses preparers. Individuals that have an interest in a job as a tax obligation specialist need to ask their state's governing body to offer them with a list of authorized training course service providers (look at this web-site).

The Facts About Federal Tax Preparation Revealed

Training courses sponsored by exclusive business may be cost-free of fee or call for just the purchase of some textbooks. In many cases, people that succeed in these programs might be offered employment by the tax prep firm. An additional option for those who have an interest in tax preparation as a career is to end up being an IRS Tax obligation Volunteer.